Young people sometimes have the instinct to cast older people aside, perhaps believing people from older generations are out of touch. Gen Z might be tempted to do this with baby boomers: “What was a house when you were young, like, $7,000?” This is actually close to the truth, at least if we use home values in 1950 as our benchmark.

See: How Many Americans Have $100,000 Saved for Retirement?

Find Out: How To Build a Financial Plan From Zero

The stark contrast between then and now can lead Gen Z to believe baby boomers are out of touch. And while it’s true things are very different now, it doesn’t mean boomers haven’t learned a thing or two in their time. Plus, many core tenets of personal finance don’t usually change from generation to generation. As a result, there are several pieces of money advice baby boomers can share with Gen Z.

Save Early, but Don’t Forget To Have Fun

It’s important to save and invest early and often, thanks to the power of compound interest. And while Gen Z should absolutely take advantage of compounding, it’s also important to enjoy life while you’re still young. That is how Manning Field, CEO of Follow, sees it. “Invest as much as you can, but don’t compromise being young and having fun,” Field said. “Establish a behavior of regularly putting money away.”

In other words, the goal is to establish a healthy habit of saving and investing regularly. However, you shouldn’t put so much money away that it hinders your ability to enjoy life. “If you want to maximize compound interest you should start as soon as possible, even if it’s small amounts of money at first,” Field said.

Take Our Poll: What Do You Plan To Use Your Tax Refund For?

Diversify Your Investments

Even if you are young, chances are you have heard about investing, even if you haven’t started investing your own money yet. But the headlines around stocks tend to center around whichever company is hot right now. While following the next hot stock can be fun, solely investing in those stocks isn’t a viable long-term investment strategy. Instead, you should diversify by investing in low-cost index funds, like an S&P 500 fund or a total stock market index fund.

This is not to say Gen Z should never invest in “hot” stocks. If you have some extra money left at the end of the month, baby boomers say there’s no harm in throwing a few extra dollars in these stocks. But generally, they shouldn’t make up the core of your investment strategy.

Consider Multiple Mortgage Types

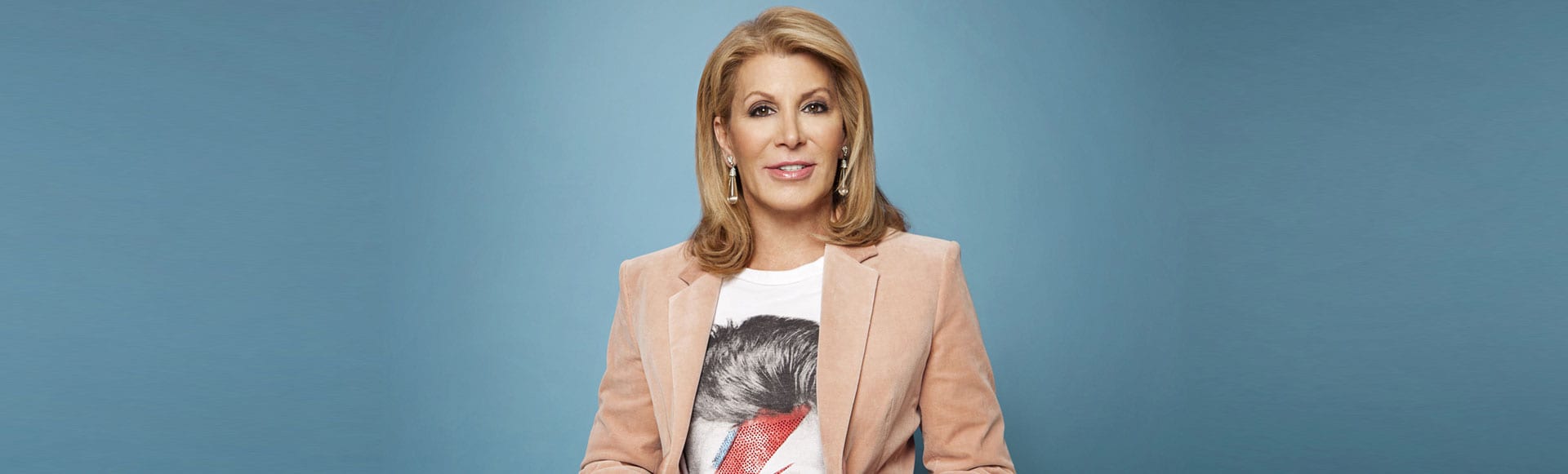

While some aspects of personal finance have changed over the years, one that has changed a lot is finance options for homes. Dottie Herman, vice chair and former CEO of Douglas Elliman, said younger buyers should shop around. “Today, there are several mortgage products buyers can qualify for based on personal needs,” Herman said. She recommends checking all available mortgage types with a qualified loan officer to find one that is right for you and your finances.

“Definitely find out how much the property taxes are. Be present when the engineer checks out the property so that you can ask questions about repairs if there is any structural damage BEFORE you go to contract,” Herman added. While there is much to think about when buying a home, doing your due diligence will lead to a better experience.

Avoid High-Interest Debt

One of the problems young people entering the workforce might encounter is not knowing how to control their spending. They might have their first job as a college graduate and could be tempted to spend a lot of money. This could lead to running up charges on a credit card, leading to a large amount of high-interest debt. But this kind of debt can trap people in a never-ending cycle of interest charges.

Because high-interest debt can be stifling, baby boomers stress that Gen Z should use credit cards sparingly. But if they do end up with large credit card balances, they should work to pay them off quickly, using debt payoff methods like the debt snowball or debt avalanche.

Choose a Career Path that Aligns with Your Personal Values

Finding the right career path is important, especially if you want to advance within your field. Money is always part of the calculation, but it shouldn’t be the only thing Gen Z should consider. Baby boomers say if Gen Z wants to be committed to their careers, it’s best to find something that aligns with their personal values. This will help reduce the chance that you will want to switch careers after just a few years.

To find the right path, you should research different careers, the skills and qualifications needed for each and the career advancement possibilities each offers. Then, see if each company has statements that delve into their corporate values and see if they align with yours. You may also want to look into things like work-life balance, job satisfaction and personal and professional development opportunities.

More From GOBankingRates