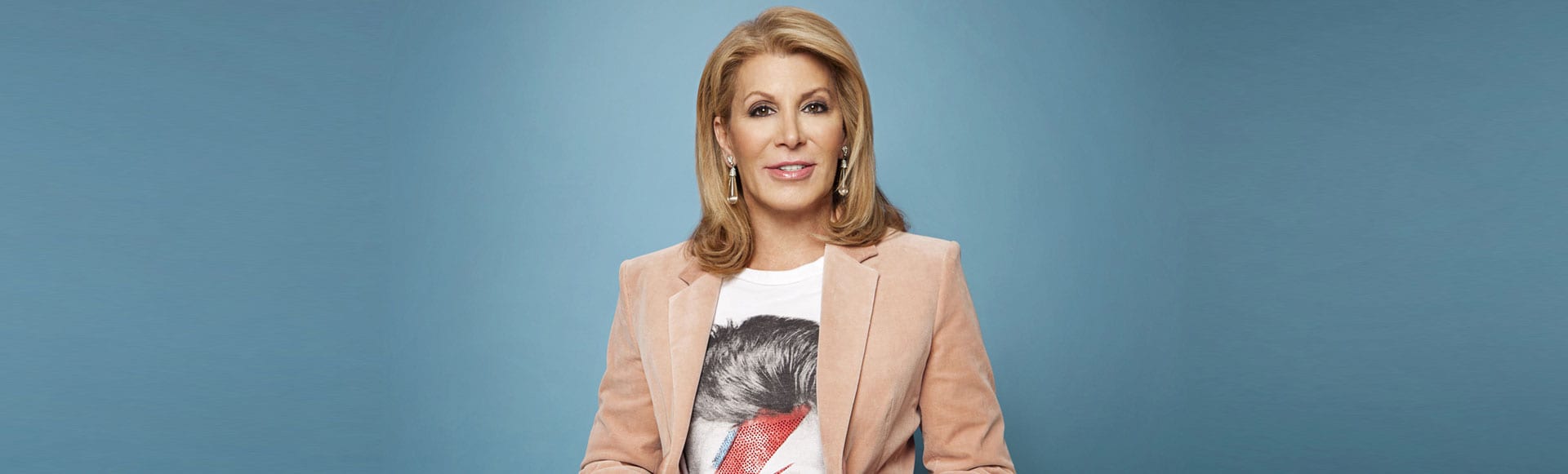

“I don’t use 2021 as the year I would compare things to because that was the year where I’d never seen interest rates that low before. I think it’s a reboot,” said Dottie Herman, vice chair of Douglas Elliman.

September 28, 2022 at 08:00 PM

Melea VanOstrand

Real Estate Reporter

The fast-paced housing market that we saw in 2021 is starting to cool nationally as new and existing home sales will continue to decrease in price over the next few months.

That’s according to Dottie Herman, vice chair of Douglas Elliman and a 30-plus-year real estate industry veteran, who says that in most of the country, it looks like home prices will appreciate about 2% to 3% into 2023.

According to Herman, in the past few years, the mortgage interest rates were under 4%. Now, they’re at 6.52%. Historically, our nation’s interest rate average is 7.5%.

“I don’t use 2021 as the year I would compare things to because that was the year where I’d never seen interest rates that low before. I think it’s a reboot. I think houses went up at 14% annually in those two years in 2021 and 2022,” said Herman. “You can’t keep that pace up. Between the rising interest rates and the fact that it’s impossible to keep that kind of appreciation up, I think you’re going to find a reset and what I consider a healthier market.”

That’s good news for buyers, who are renting after struggling with bidding wars and high home prices.

“If you didn’t have all cash, you didn’t have a chance and there was no negotiability. That was it. You either take it or leave it,” said Herman. “Now there’s more negotiability. You can negotiate with the homeowner, and there’s less competition.”

Despite rising rates, it’s still a good time to buy a home. For sellers, the price a home sells for won’t be as high as what they would’ve gotten in 2021.

“At the same token, sellers’ equity increased in the past two years,” said Herman. “It increased by that 14%, which is not usually heard of. I think it’s going to move along. People need houses.”

The problem the housing market faces is supply and demand. There are more buyers than homes available, which is what drives home prices up. According to The MIAMI Association of Realtors’ August 2022 market focus report, total home sales in Miami-Dade decreased by 24% based on a year-over-year comparison.

Herman says it’s the responsibility of brokers and real estate professionals to prioritize getting more listings.

The total number of active listings in Miami-Dade decreased by 10.4% where it takes an average of 3.3 months for a single-family home or condo to be sold after it’s on the market. Although it’s still a seller’s market, Herman says it’s starting to change.

The demographic looking for homes the most are millennials.

“The millennials don’t need huge houses. They want a sense of community, so they generally don’t want to have a big estate like the baby boomers,” said Herman. “They don’t want to have to drive an hour to get anywhere. They want to be able to connect, and nice homes that aren’t as big.”

In both Broward and Palm Beach counties, the number of active listings increased, where it takes between 2.5 to 2.7 months to sell a single-family home or condo. Broward’s active listings increased 13.1%, while Palm Beach County’s increased 46%.

Are We in a Recession?

According to Forbes, the country entered a recession this summer after two straight quarters of negative gross domestic product.

“Actually nobody really knows, but again, I don’t see anything big. I still see some appreciation, and I think that one factor that is very important is that we have a shortage of inventory, and although we’re getting a little bit more than what we had, it’s still well below what we need,” said Herman.

The biggest challenge the housing market may see next is an increase in foreclosures or rent delinquencies.

“I do see a lot of foreclosures and delinquencies and people not paying. Depending on the state, you may not get thrown out for a long time,” said Herman. “You can try to go to the bank and try to work something out.”

In Florida, the federal eviction ban is no longer in place, so landlords can evict a tenant with three days’ notice for failure to pay rent.

While fears of higher mortgage rates may deter people from buying a

home, mortgage rates have decreased in the last six recessions, which means historically rates typically go down.

In Miami-Dade, the median sales price of a single-family home increased 10.1% to $551,250, and the price of a condo or townhome rose 11.9% to an average of $375,000. In Broward, single-family home prices increased 13.6% to $562,500, and condos and townhomes increased 20.5% to $265,000. In Palm Beach County, prices rose 17.7% to $565,000 for single-family homes and went up 25.4% to $291,000 for condos and townhomes.

It’s hard to lose in the current housing market if you currently own a home, Herman says, as home values went up.

“The only way you would lose is if you bought a house at the height at the market, and you have to sell it right away,” she said.

1 Comment

Good information. I’m sending this article to all my agents to incorporate in their marketing materials.

Thanks much,