Current 30-year jumbo mortgage rates were about 7.3% in December 2023, significantly higher than the low rates offered just two years prior. Jumbo rates are currently similar to those on 30-year conforming loans, which are 7.03%.

In most of the United States, the conforming loan limit for 2024 is $766,550, an increase of about $40,000 from 2023. In designated high-cost areas, including Alaska, Hawaii, Guam and the U.S. Virgin Islands, the conforming limit is $1,149,825. Loans that exceed these limits are considered jumbo mortgages and often come with slightly higher interest rates to offset the increased risk to the lender.

Current 30-year jumbo mortgage rates

In mid-December, 2023, the average 30-year jumbo mortgage rate was 7.333%, according to FRED data. Two years prior, the average 30-year jumbo mortgage rate was 3.18%. This is consistent with the drastic rise in mortgage rates over the past two years. At the December average of 7.333%, a 30-year, $850,000 mortgage would result in a monthly payment of $5,844 and a whopping $2.1 million in overall costs.

Jumbo rates vs. conforming loan rates

The primary difference between a jumbo mortgage and a conforming loan is the amount of money being borrowed. Jumbo mortgages carry more inherent risk for lenders due to their size.

Traditional, conforming mortgages can be purchased by government-sponsored entities Fannie Mae and Freddie Mac. Lenders can’t unload the jumbo loans they originate to Fannie Mae and Freddie Mac, so they take on added risk for this reason, too.

Because of the additional risk involved, lenders commonly impose stricter requirements on jumbo loan borrowers. And jumbo mortgage rates can be higher than conventional mortgage rates. However, there can be exceptions to this rule — jumbo mortgage rates are currently comparable to conforming 30-year mortgage rates.

Jumbo mortgage rate trends

Jumbo mortgage rates follow a similar pattern to conforming mortgage rates. During periods of strong buyer demand (usually a sign of a strong economy), rates tend to rise. When mortgage demand is sluggish, lenders tend to lower their rates.

In mid-2020, mortgage lenders began offering record-low rates in response to the financial crisis triggered by the COVID-19 pandemic. By late December 2020, the average 30-year jumbo mortgage rate hit an all-time low of 2.812%.

In 2022, mortgage rates began to rise due to rampant inflation and Fed rate hikes. Jumbo rates followed suit. By October 2023, less than three years after the record-low rates, the average jumbo mortgage rate hit a record high of 8.232%.

Forecasting jumbo mortgage rates

Economic factors and buyer demand are big drivers of mortgage rates, jumbo rates included. A strong economy can lead to inflation — when that happens, the Federal Reserve steps in and raises interest rates, leading to an uptick in mortgage rates.

In March 2022, the effective federal funds rate (the benchmark interest rate overseen by the Fed) was 0.20%. As of December 2023, it was 5.33%. That helps explain why jumbo mortgage rates are where they are today.

Whether jumbo mortgage rates drop during the 2024 calendar year will hinge largely on the Fed’s policymaking and homebuyer demand. Demand has been strong lately by virtue of limited housing supply. If the Fed cuts rates in 2024, which is possible as inflation continues to cool, jumbo mortgage rates could follow.

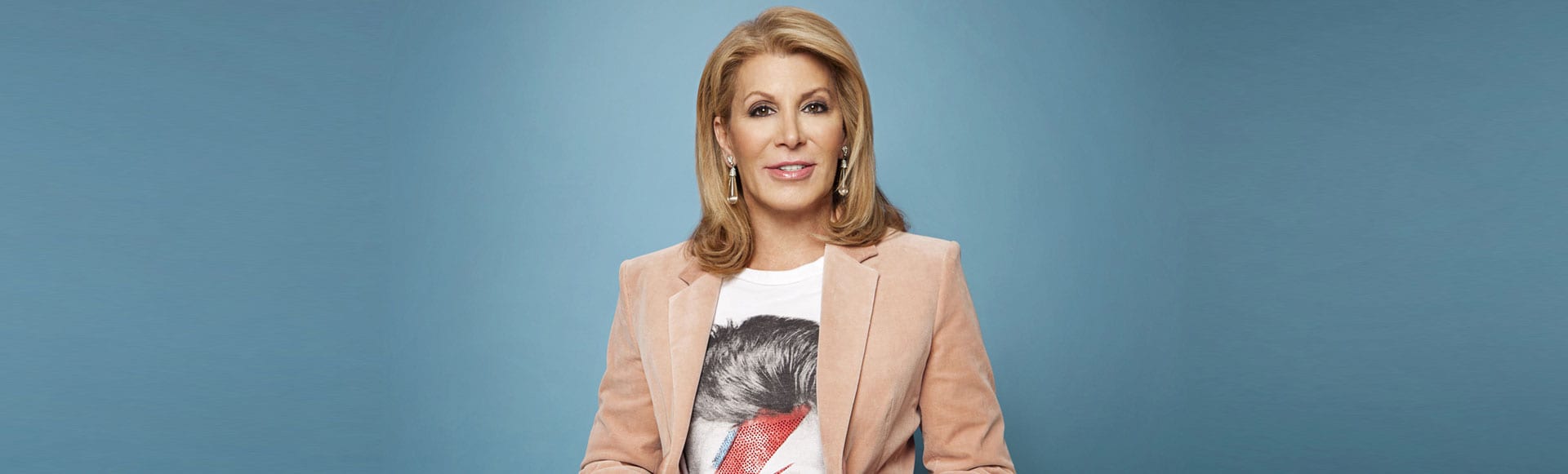

“I think you might see jumbo mortgage rates drop in the spring of 2024,” said Dottie Herman, vice chair of Douglas Elliman, a national real estate brokerage firm. “But it’s very difficult to predict the market, especially the way it’s been the last few years.”

How to get the best 30-year jumbo mortgage rates

The lower your jumbo mortgage rate, the more affordable your payments will be. To snag a competitive rate on a 30-year jumbo mortgage, consider the following tips:

- Improve your credit scores by paying bills on time, using a lower proportion of your credit card limit, maintaining long-standing credit accounts and checking your credit reports for errors by visiting AnnualCreditReport.com.

- Shop around, as different lenders set different rates. Expect to see greater variation between types of lenders, such as banks versus credit unions or online financial institutions.

- Make as high a down payment as you can afford to minimize the sum you’re borrowing. Jumbo loans commonly require a 20% down payment, but the more, the better. Budgeting can help you leave enough cash flow to afford your monthly mortgage dues.

- Keep your debt-to-income (DTI) ratio as low as possible by paying down debt and boosting your income. Many lenders look for a DTI ratio no higher than 43%, but the lower, the better, especially for a jumbo loan.To determine your DTI ratio, divide your total monthly debt payments by your gross monthly income. For example, if your debt payments equal $2,000 and you earn $5,000 pre-tax, your DTI ratio would be 40% ($2,000 / $5,000 = 0.40).

- Aim for a consistent employment history, which generally means staying at the same job or in the same industry for at least two years. Better yet, seek a promotion and raise to push your DTI in the right direction.

- Explore different loan programs, such as an FHA loan if you have a lower credit score, a VA loan if you’re a military member or vet, or a USDA loan if you’re buying in a rural area. Jumbo FHA loans exist, but if you have poor credit, exercise caution — be careful not to overextend yourself and accept a loan you can’t afford.

- Pay mortgage points to buy down your rate if you plan to stay in the home for years. One point generally costs 1% of your loan amount and reduces your interest rate by 0.25 percentage points. That rate reduction may not sound like much, but it can add up to big savings over a 30-year term. Start by calculating your break-even point, or the amount of time it’ll take to recoup the cost of buying points — divide the cost of the points by the amount you save each month on your monthly dues.

Example: Let’s say you qualify for an 8% rate on a 30-year term for a $900,000 loan. Your monthly payment would be about $6,600, and you’d pay about $2.38 million over the loan term.

However, if you employed some of the strategies above and qualified for a rate of 7.25% instead, your monthly dues would drop to $6,139 and you’d save more than $167,000 overall.

Pros and cons of a jumbo mortgage

| Pros | Cons |

|---|---|

|

|

Jumbo mortgages make it possible to buy a more expensive home because they don’t have to conform to preset borrowing limits. If you’ve got your eye on a luxury home — and you can afford the payments — a jumbo loan can help you make it yours. Real estate investors also use jumbo loans to capitalize on expensive markets likely to enjoy rapid growth.

Interest rates on jumbo mortgages sometimes mimic those of conforming loan rates, which is the case today. Since the lender has to keep the loan in its portfolio (rather than sell it to Fannie Mae or Freddie Mac), it may be willing to agree to nonstandard repayment terms or other personalized options.

On the other hand, because jumbo mortgages carry more risk, lenders tend to be stricter when assessing your creditworthiness. You’ll probably need a higher income and credit scores to qualify for a jumbo mortgage, and your lender may require a higher down payment at closing. Also, while jumbo mortgage rates can be comparable to conforming mortgage rates, they can sometimes be slightly higher.