Recent rules brought more transparency to Realtor commissions, but agents still offer an edge to both buyers and sellers

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate mortgages to write unbiased product reviews.

The rules of the recent NAR settlement went into effect in August. We talked to real estate pros to see what’s changed.

Buyers can still benefit from working with a real estate agent, and in many cases, the seller may still cover the cost.

Sellers can always negotiate both with their agent and with the buyer on how much they’ll pay.

Earlier this year, the National Association of Realtors agreed to a $418 million settlement that made some big changes to the way we buy and sell homes.

These changes went into effect on August 17, 2024. Before the rules of the settlement were implemented, it was unclear exactly what impact it would have on the homebuying process. Would buyers stop using real estate agents to purchase a home? Will first-time homebuyers be shut out of the process because they have less cash to bring to the transaction?

Two months later, we talked to real estate professionals from around the country to see how the homebuying process has evolved post-NAR settlement.

How has the homebuying process changed after the NAR settlement?

Here’s the fine print of what’s changed:

Homebuyers now have to sign a contract, sometimes called a buyer-broker agreement, to be able to work with a real estate agent.

If a seller is offering to compensate the buyer’s agent, that information can’t be advertised on the MLS, which is the database that real estate professionals in a given market use to find and list properties for sale. Sellers can still offer concessions on the MLS, which allow the seller to pay some of the buyer’s closing costs or other expenses related to getting a mortgage and purchasing a home.

In some markets, not much has changed

What have these changes looked like in practice? Depending on the norms in your market, you might not notice much of a difference.

Traditionally, sellers have been the ones who paid both their agent’s commission and the buyer agent’s commission. Many speculated that the NAR settlement would see fewer sellers offering commissions, requiring buyers to pay their agents out of their own pockets. But in many areas, that hasn’t been the case.

“I have yet to come across a listing that hasn’t offered at least some level of compensation,” says Blake Blahut, broker associate at Realty ONE Group Inspiration in Orlando.

Other real estate pros we talked to confirmed this.

“It definitely creates confusion for buyers because a lot of them think that they’re obligated to pay the buyer’s broker, which is not necessarily true,” says Jennifer Okhovat, a real estate agent with Compass in Los Angeles. In Okhovat’s market, sellers generally still pay the buyer agent’s commission.

Sellers can still pay commissions, but there may be more negotiating

Commissions have always been negotiable, but that hasn’t always been obvious to buyers and sellers. Now, there may be more back and forth between the seller and the buyer as they figure out who pays for what.

For example, a seller may be willing to pay the buyer agent’s commission, but they might try to negotiate it down.

If you want to buy a home but the seller is unwilling to pay your agent’s commission, you’ll need to pay it yourself or find a different home. Mortgage lenders won’t let you finance agent commissions, so you’ll pay this cost out of pocket.

Buyers need to sign an agreement with their agents

As a buyer, before your agent can do any work for you or show you any houses, you’ll need to sign a buyer-broker agreement. This agreement will outline how much your agent will be paid for their services.

“It outlines how compensation works,” Blahut says.

This is often a percentage of the price of the home you purchase, but it could also be a specific dollar amount or an hourly rate. You can negotiate this amount before you sign.

What homebuyers and sellers should know post-NAR settlement

Working with a buyer’s agent is often still worth it

Having a buyer’s agent can still be extremely valuable.

“Where agents a lot of times add value is in their network, knowledge, resources, and their ability to go above and beyond,” says Danielle Andrews, a real estate broker at Realty ONE Group Next Generation in Tallahassee, Florida.

Agents can give you useful information about a house or help you identify problems that could turn into costly repairs down the road. And importantly, they work for you.

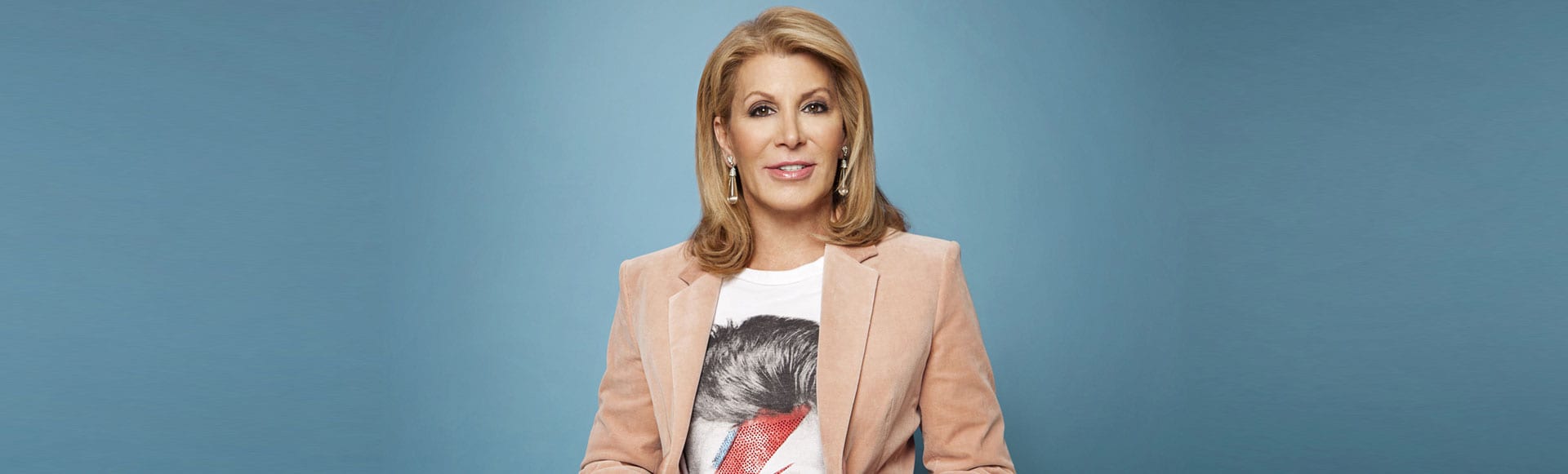

Dottie Herman, vice chair for Douglas Elliman Real Estate in New York City, says that a seller’s agent (commonly called a listing agent) has a duty to do what’s best for their client, the seller. So if you’re making an offer to them, they won’t tell you if the house is overpriced or if the seller would be willing to accept less than the asking price. An agent that’s representing you will tell you these things.

“If I was a buyer, I’d want to have representation,” Herman says.

But make sure to find an agent that brings value to the transaction

There are a lot of real estate agents out there, and not all of them excel at what they do.

Ask friends or family for recommendations, and talk to a few different agents to get a sense of who you work well with. Blahut says to interview prospective agents as if you’re hiring someone for a job.

Understand what you could owe when you sign a buyer-broker agreement

Andrews says buyers should ask a lot of questions prior to signing a contract with an agent. Find out how long the agreement is for, what happens if you want to back out, and if you’ll owe a retainer or any other fees on top of the agent’s commission.

Offering compensation as a seller can still be a smart move

As a seller, not paying the buyer agent’s commission can help you save money. But it might make it harder for you to attract buyers.

When deciding whether to offer compensation to the buyer’s agent, talk to your agent about what makes sense in your local market.

“It’s important that agents are giving an accurate market expectation,” Andrews says. If buying demand has slowed in your area and there aren’t that many buyers looking for homes, “you may not want to add an additional barrier of needing to negotiate on commission.”

Molly Grace

Mortgage Reporter