If you’re looking to buy a home in 2025, you may want to make a move sooner rather than later. Waiting for interest rates to fall could cause you to lose out on the home of your dreams, as it is still a seller’s market. Some real estate agents even believe prices may continue rising in some areas.

Learn More: 7 Types of Homes Expected To Soar in Value by the End of 2025

Find Out: How To Get Rich in Real Estate Starting With Just $1,000

“I think the market will be relatively flat with a potential for modest price increases,” said Robert Washington, Founder at Savvy Buyers Realty in Clearwater, Florida. “As interest rates start to come back down, I think we will see an uptick in buyer demand.”

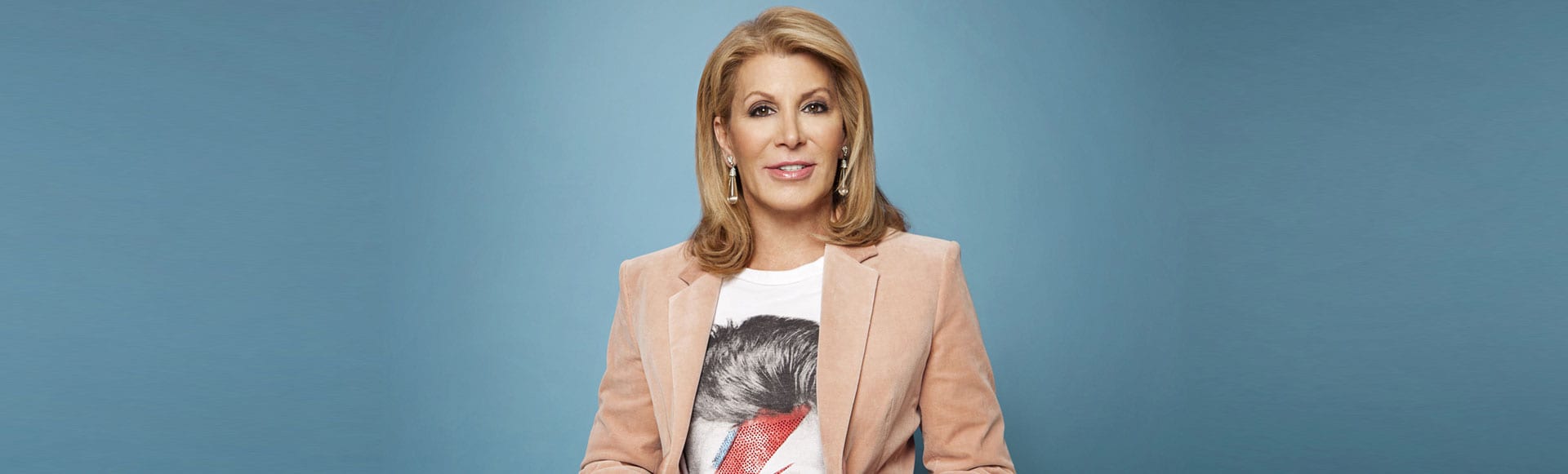

Dottie Herman, Vice Chair and former CEO at Douglas Elliman Real Estate, said the market has started to stabilize, but we might see housing price increases of less than 5% in some areas. She also said she believes we may see another interest rate cut in 2025, but it won’t create a large surge of buyers. “I think we’re going to see interest rates come down, but I don’t think drastically; I think we’ll see them come down slowly.”

Falling interest rates are one thing to watch. While they aren’t a red flag (per se), you’ll need to lock in at the right time to save money, yet make an offer on the home fast enough to avoid losing out to a cash buyer.

Red flags in 2025 relate to homes that need extensive repairs, sellers who want you to waive a home inspection, and buyers who aren’t pre-approved or try to negotiate beyond the cost of repairs needed. GOBankingRates asked several experts across the U.S. how buyers and sellers alike can avoid costly real estate red flags in the coming year — here’s what they had to say:

Trending Now:

Don’t Lock Into a 30-Year Mortgage

Herman advised buyers not to feel compelled to lock into a 30-year, fixed rate mortgage, especially if signs from the U.S. Federal Reserve point to more interest rate cuts.

“Most people don’t even stay in their home for 30 years. You may want to look at an adjustable-rate mortgage, because they start cheaper,” she said. There’s an important caveat here: Make sure the top rate is a number you can live with.

Consider This: 7 Worst States To Buy Property in the Next 5 Years, According to Real Estate Agents

Shop Based on What You Can Spend, Not Just How Much the Bank Will Lend You

Getting a mortgage pre-approval is an important part of the home-buying process. But you don’t want to make yourself house-poor if expenses like dining out, travel and other endeavors are more important to you than a big, beautiful home.

“Go to interview three banks, three mortgage companies,” Herman said. “Find out what the bank will lend you. Once you know what the bank will lend you, look at that number and decide what is comfortable for you to spend. What you can borrow doesn’t mean that’s what you should spend.”

Beware of Sellers Who Want You To Skip the Home Inspection

In a seller’s market, homeowners often ask prospective buyers to waive the home inspection. Realtors we spoke with agreed this is a bad idea. “Everyone should definitely have an engineer’s report. No one should bypass doing it,” Herman said.

She recommended walking through the house with the home inspector who can point out damage and estimated repair costs to help you negotiate a better price.

Look for Structural Damage, Foundational Issues and Signs of Flooding or Leaks

During the walk-through, pay close attention to signs of major structural damage and foundational issues, Herman advised.

Michelle Griffith, luxury real estate broker at Douglas Elliman, agreed. “Buyers should do their due diligence in contracting a good property inspector to give a thorough review of the condition of the property so there are no surprises on potential foundation issues, water damage or plumbing issues. If there are signs of water intrusion, remediation can be costly to the buyer depending on the extent of mold found in the property,” she said.

Watch Out for Homes With Older Appliances

Older appliances, as well as an aging roof or oil burner, may not be a reason to walk away from a home, but you may want to reduce your offer. “Know the age of all of the big-ticket items and when you will likely need to replace them,” Washington said. “If you have to replace a roof or HVAC system soon after buying the home, that can be a budget killer.”

Be On Guard for Buyers Who Try To Overstate Repair Costs

Ideally, the seller will also have a home inspection prior to listing the property. This way, they will know what repairs are needed and how much they will cost. “Typically, it is important to have any foundation issues or leaks repaired prior to coming to market,” Griffith said. A home in stellar condition gives the buyer fewer reasons to negotiate, potentially leading to a higher selling price.

If you opt not to make repairs in advance, make sure the listing agent knows how much the repairs actually cost, Washington advised. “Some buyers will request large seller credits or price reductions for relatively minor items that come up in a home inspection.”

Use Caution With Buyers Who Aren’t Pre-approved

“I would not take a buyer, unless they were buying all cash, that did not have a mortgage pre-approval,” Herman warned. “What you don’t want as a seller is to wait six weeks and then find out that person can’t get a mortgage.”

Time is money, and every second your home is in contract without selling, you could be missing out on better offers from more qualified buyers. “Every day you are pending and off the market can cost you,” Washington agreed.