Buying a new home isn’t cheap, but careful negotiating can allow you to save money. Whether you’re still searching or currently under contract, it’s important to negotiate as many expenses as possible.

“It’s important for buyers to be assertive in their negotiations and to advocate for themselves to get the best possible deal,” said Adie Kriegstein, a licensed real estate salesperson at Compass Real Estate, based in New York City.

Find Out: 15 Cities Where Houses Are Best Bargains Right Now

See: 3 Things You Must Do When Your Savings Reach $50,000

Before starting negotiations, she said you need to do your research.

“Examine the local real estate market, including comparable home sales and the typical closing costs in your area,” she said. “Don’t be afraid to walk away from a deal if the seller isn’t willing to negotiate on certain costs that are important to you.”

She said you’ll need to be respectful and remember that negotiating should be a give-and-take process.

“Don’t make demands or try to bully the seller into giving you what you want,” she said. “Consider working with an experienced and seasoned real estate agent as they can help you navigate the negotiation process and provide valuable insight and advice.”

Chances are, you can think of a few costs to negotiate, but there are likely several you hadn’t considered. Here’s a look at eight expenses to try to save money on by negotiating with the seller during the buying process.

Furnishings and Fixtures

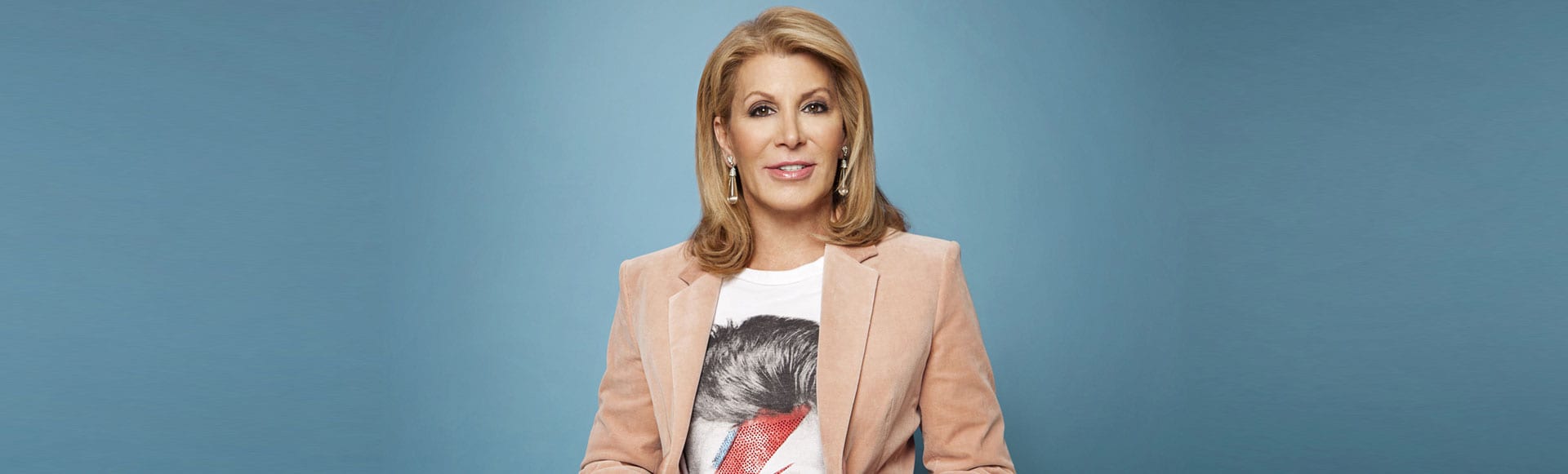

Making a new house look and feel like home can be expensive and time-consuming if you have to purchase a lot of new furniture and fixtures. However, Dottie Herman, vice chair and former CEO of Douglas Elliman based in New York City, said you might be able to save money on at least some of these items by working them into the deal.

“After the price of the house is agreed upon, then other things can be negotiated,” such as built-in furniture, a pool table, light fixtures [and] other personal items not included in the sale, she said. “There may be custom-made furniture in the house that won’t fit right in their next home and they might just want to get rid of it for a reasonable price.”

Be Aware: 5 Expensive Renovations Homeowners Always Regret

Housing Market 2023: Prices Are Now So High That Banks Are Losing Money on Mortgages

Mortgage Points

“Mortgage points can also be negotiated and be a big cost savings for the buyer,” Herman said. “If the seller pays part of the mortgage and if the property is worth over a million dollars, the seller can be asked to pay a ‘millionaire’s tax’ or ‘mansion tax.'”

Do note, this type of tax only exists in certain states and local municipalities. If the home you’re purchasing is priced at $1 million or more, check with your real estate agent to see if this type of tax exists in your local area.

Find Out: 7 Florida Cities That Could Be Headed for a Housing Crisis

Closing Costs

“Closing costs are included in the initial price and mostly paid by the seller,” Herman said.

Generally speaking, some of costs the buyer might typically be expected to cover may include appraisal, title search and attorney fees, according to Kriegstein.

“In New York City, part of the closing costs in new developments are city and state taxes and only in a new development sale are they put on the buyer,” she said. “As such, a buyer can negotiate those fees as well.”

She said buyers can also ask the lender to pay at least some of their closing costs, in exchange for a higher interest rate.

Home Inspections

In most cases, you’ll likely opt to have a home inspection, to find out if there are any underlying issues with the property that need to be addressed. This typically costs around $281-$402, according to Angi, but it can present opportunities to save.

“If a seller has already recently had an inspection done, they can share that report with a buyer,” Kriegstein said. “Should the home inspection reveal any issues that need to be fixed, the buyer can negotiate with the seller to have them repaired before closing or to lower the purchase price to reflect the cost of repairs.”

Home Warranty

“A home warranty is a service contract that covers the repair or replacement of certain home systems and appliances,” Kriegstein said. “The seller may be willing to pay for a home warranty for a period of time after the sale, which can save the buyer money on unexpected repairs.”

The average cost of a home warranty is $300-$800, according to Zillow. Most policies cover select major household appliances, HVAC systems, plumbing systems and certain electrical issues.

Check Out: These Are the 10 Most Overpriced Housing Markets in the US — 5 Are in Florida

Homeowners Association Fee

“If the property is part of an HOA, the buyer can negotiate with the seller to pay a portion of the HOA fees for the first year or to have the seller pay any outstanding HOA fees,” Kriegstein said.

HOA fees for a typical single-family home average $200-$300 per month, according to Realtor.com. This equates to $2,400-$3,600 per year, so even negotiating for the seller to pay part of this fee for the first year can offer notable savings.

Property Taxes

If you’re a first-time homebuyer, you might not be familiar with property taxes. Based on the value of the property, these taxes fund local expenses, such as school districts and community projects — and they can seriously increase your monthly housing payment.

“Buyers can negotiate with the seller to pay a prorated share of the current year’s property taxes or to split the cost of property taxes for the year of closing,” Kriegstein said.

This can give you extra cash to spend on moving and getting settled into your new home.

Closing Date

Coordinating a move can be tricky, but Kriegstein said you might be able to have control over when you get the keys to your new place.

“If the buyer needs to move in by a certain date, they can negotiate with the seller to ensure that the home is ready for occupancy by that date,” she said.

This can ensure you’re able to vacate your current space without having to pay an extra month’s rent or spend the interim in temporary housing.

More From GOBankingRates

- 10 Aldi Brand Products Worth Buying

- Learn To Master Your Money With These Financial Tips

- 3 Things You Must Do When Your Savings Reach $50,000

- 48 Easy Things You Can Do To Live Better and Save Money

This article originally appeared on GOBankingRates.com: Real Estate 2023: 8 Costs Every Homebuyer Should Negotiate